RBF vs Traditional Financing: Which is right for your small businesss?

by Bud Gleason

In today's rapidly evolving business environment, small businesses face a myriad of challenges when it comes to securing the funding necessary to fuel growth and innovation. Among the various financing options available, two approaches stand out: Revenue Based Financing (RBF) and traditional financing methods. In this comprehensive guide, we'll delve deeper into the intricacies of both RBF and traditional financing, offering insights and recommendations to help you make informed decisions about which approach is best suited to your small business needs.

Understanding the Financial Landscape

Before diving into the specifics of RBF and traditional financing, it's essential to understand the broader financial landscape that small businesses operate within. From navigating cash flow challenges to managing operational expenses and planning for future growth, small business owners face a multitude of financial considerations on a daily basis. By gaining a deeper understanding of these challenges, you'll be better equipped to evaluate the pros and cons of different financing options and make strategic decisions that support your long-term success.

The Case for Revenue Based Financing (RBF)

Revenue Based Financing (RBF) has emerged as a compelling alternative to traditional financing methods for small businesses seeking growth capital. Unlike traditional loans or lines of credit, which often require collateral or personal guarantees, RBF provides funding based on a company's future revenue streams. This innovative approach allows businesses to access capital without sacrificing equity or taking on additional debt, making it particularly appealing for startups and early-stage ventures with limited assets or track records.

One of the key advantages of RBF is its flexibility. Instead of fixed monthly payments, RBF arrangements typically involve repayments that fluctuate based on a percentage of the company's revenue. This means that during periods of strong sales, businesses will pay back more quickly, while slower periods allow for reduced payments, providing a built-in level of financial flexibility that traditional loans often lack.

Furthermore, RBF can be a valuable tool for businesses with predictable recurring revenue streams, such as subscription-based companies or those with long-term contracts. By leveraging future revenue to secure financing, businesses can access the capital they need to invest in growth initiatives without tapping into their existing cash reserves or diluting ownership stakes.

Exploring Traditional Financing Methods

While RBF offers numerous benefits for small businesses, it's essential to consider the full range of financing options available. Traditional financing methods, such as bank loans, lines of credit, and venture capital funding, have long been staples of the business world and continue to play a crucial role in providing capital to entrepreneurs and small business owners.

One of the primary advantages of traditional financing is its familiarity and accessibility. Banks and financial institutions are well-established sources of funding for businesses of all sizes, offering a wide range of loan products and credit solutions tailored to meet the needs of diverse industries and business models. Additionally, venture capital funding can provide significant capital injections for high-growth startups, albeit often at the cost of equity ownership and control.

However, traditional financing methods also come with their own set of challenges and limitations. For example, securing a bank loan or line of credit may require extensive documentation, collateral, and a strong credit history, making it difficult for early-stage businesses or those with limited financial resources to qualify. Similarly, venture capital funding often involves complex negotiations and strict terms that can impact a company's long-term trajectory and strategic direction.

The Benefits of B2B BNPL in Business Transactions

In recent years, Buy Now, Pay Later (BNPL) solutions have emerged as a popular alternative to traditional payment methods, offering consumers and businesses alike greater flexibility and convenience when making purchases. In the B2B space, BNPL solutions can be particularly beneficial for small businesses seeking to manage cash flow and streamline transactions with suppliers and vendors.

By allowing buyers to defer payments or break them into manageable installments, BNPL solutions enable businesses to access the products and services they need while preserving capital for other essential expenses. Additionally, BNPL can help businesses build stronger relationships with their suppliers by offering flexible payment terms and reducing the administrative burden associated with traditional invoicing and payment processes.

Insights from Ratio Tech: A New Approach to Financing

Ratio Tech, a leading provider of innovative financing solutions for small businesses, is at the forefront of this financial revolution. With a team of seasoned entrepreneurs, SaaS experts, and finance professionals, Ratio Tech is redefining the way small businesses access capital and manage their finances.

By leveraging the power of RBF and BNPL, Ratio Tech provides small businesses with flexible, non-dilutive financing options that align with their unique needs and growth objectives. Through strategic partnerships and collaborative efforts with businesses across various industries, Ratio Tech is empowering entrepreneurs to realize their full potential and achieve sustainable growth.

Interview with Ratio Tech's Chief Marketing Officer

In a recent interview, Ratio Tech's Chief Marketing Officer, Victor Thu, shed light on the company's innovative approach to financing and its impact on small businesses. According to Thu, Ratio Tech's RBF and BNPL solutions offer small businesses a streamlined and hassle-free way to access the capital they need to grow and thrive.

"For traditional solutions, especially for smaller companies, they probably have to build their own team to be able to determine how they can provide financing to their customers," Thu explained. "Even though they may not think of it as financing, enabling their customers to buy with a monthly payment or some sort of a flexible payment mechanism is actually a cost for the tech companies. Therefore, they may have to raise more funds or go to the bank to get more cash in order for their operation to proceed normally."

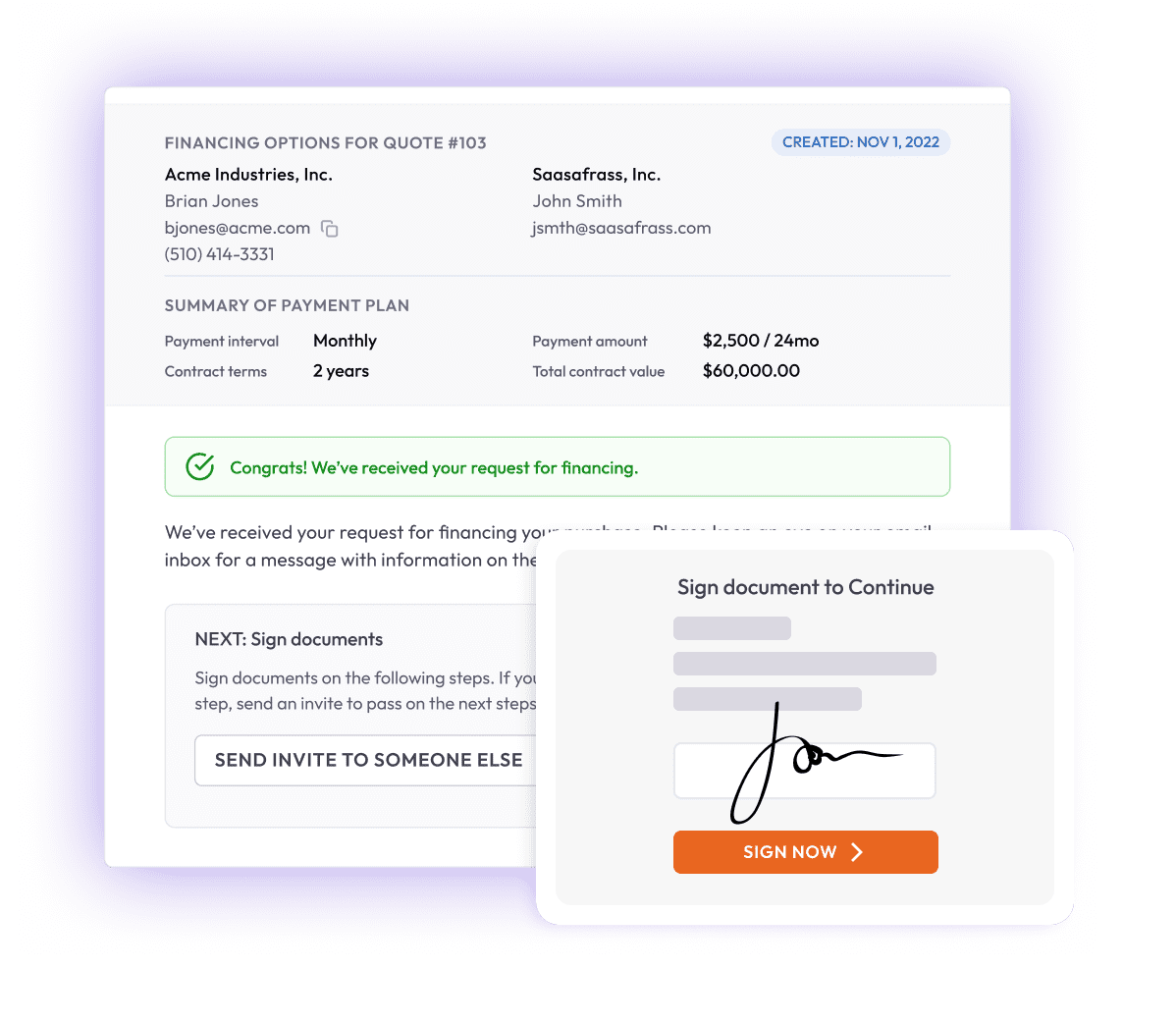

"Whereas with Ratio Tech, they don't need to worry about having to do a credit score against the buyers or have a team that focuses on collecting funds from their customers. All of these mechanisms are already built into Ratio Tech’s offering, so any other companies who use Ratio have access to these financial vehicles and their burden is now eliminated. Now, the tech companies have a way to finance their customers and Ratio Tech provides that mechanism on their behalf."

Navigating the Financial Landscape: A Summary

In conclusion, the choice between RBF and traditional financing ultimately depends on your small business's unique circumstances, financial goals, and growth trajectory. While traditional financing methods offer familiarity and accessibility, RBF provides flexibility and scalability that can be invaluable for startups and early-stage ventures.

With the emergence of BNPL solutions, businesses now have even more options when it comes to managing cash flow and streamlining transactions. By partnering with innovative companies like Ratio Tech, small businesses can access the capital and financial resources they need to succeed in today's competitive marketplace.

Whether you're exploring RBF, traditional financing, or the benefits of B2B BNPL solutions, it's essential to conduct thorough research, evaluate your options carefully, and seek guidance from financial experts who understand the intricacies of your industry. By taking a strategic and informed approach to financing, you can position your small business for long-term success and sustainable growth.

In today's rapidly evolving business environment, small businesses face a myriad of challenges when it comes to securing the funding necessary to fuel growth and innovation. Among the various financing options available, two approaches stand out: Revenue Based Financing (RBF) and traditional financing methods. In this comprehensive guide, we'll delve deeper into the intricacies of…

Recent Posts

- The Aging Population and Dentures: Addressing Oral Health Challenges in Las Vegas

- The Aging Population and Dentures: Addressing Oral Health Challenges in Las Vegas

- Shattered Dreams: Knoxville’s Premier Destination for Phone, PC, and Tablet Repair

- The Beginner’s Guide to Real Estate Investment with Robinhood REI

- Oh My Auto Detailing: Your Destination for Premier Car Detailing in Clearwater